Get Better at Buying Life Insurance

- wealthchecktt

- Jul 7

- 12 min read

Most of us are completely out of our depth when it comes to life insurance. It's not surprising why though; these things aren't taught in school and it's not exactly exciting enough for us to seek out the knowledge on our own.

It can be tough to make important financial decisions about the future, especially when there are consequences for making the wrong one. Unfortunately, we sometimes let anxiety get the better of us and end up putting it off for too long.

If you're thinking about getting life insurance but you're not sure where to begin, this guide will help set your mind at ease. While not exhaustive, it covers most of the things that you should take into consideration when evaluating the life insurance options available in Trinidad and Tobago.

Choosing An Insurance Provider

In T&T, there are quite a few companies that specialise in offering life insurance solutions so we aren't starved for options:

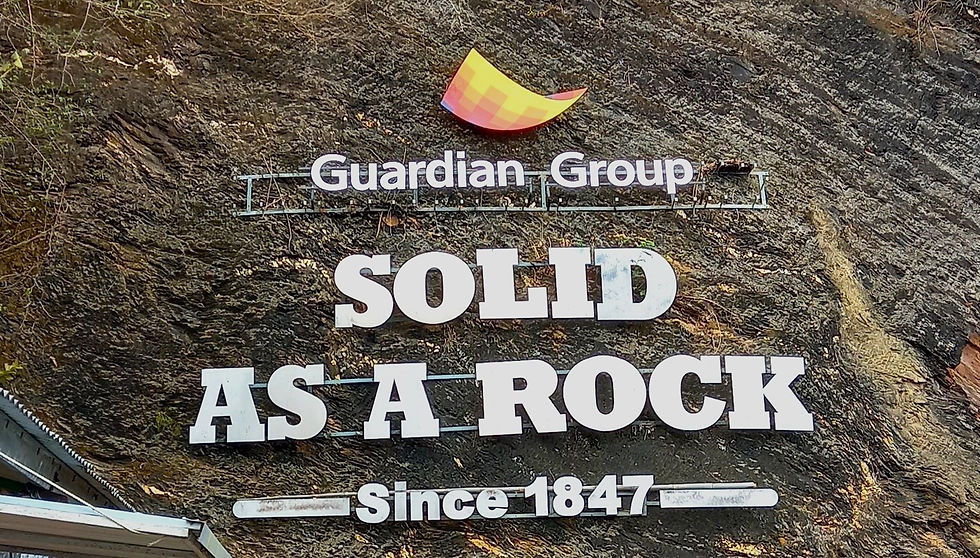

It goes without saying that you should choose an insurance company that will be around to honour their end of the deal when the time comes. Imagine your children's frustration when they go to submit a claim on a life insurance policy you took out with ALGICO 20 years ago only to find out that the company had been sold twice and is now owned by the Pan American Insurance Group. Did you know that Assuria Life was called Mega Insurance before and GTM Insurance before that? And who could forget about what happened to CLICO in the wake of the global financial crisis of 2008?

In fact, there have been several mergers and acquisitions in the insurance sector in the past few decades. It is not a comforting thought to know that there has already been an attempt to sell ScotiaLife. Can you really trust that they'd still be around when your children go to make a claim on your life insurance policy when you pass away? It's best to stick with an insurance company with a long and stable track record with competent leadership that will ensure longevity.

Choosing an Insurance Agent

Some insurance companies, like Guardian Life and Sagicor Life, have begun offering life insurance policies that you can apply for online without the need for an agent. But if you prefer the personal touch when making important financial decisions, then you would appreciate the guidance that an agent provides. They are supposed to address any concerns you have, clarify anything that confuses you and help you to get adequate and affordable insurance coverage within your budget.

Keep in mind though, that insurance agents are not true financial advisors like a Certified Financial Planner (CFP) is. They are not obligated to act in your best interest. They are salespeople whose primary motivation is financial compensation. Some are willing to misinform, mislead, fail to disclose or flat out lie when they are desperate to make a sale so they can earn a commission. That doesn't mean that they are all dishonest all of the time though. There are many knowledgeable and trustworthy insurance sales professionals out there. To identify them, you may want to consider the following:

Check their credentials; do they have any finance-related qualifications aside from training in sales? While not necessary, it speaks volumes when an agent chooses to invest in their education by pursuing the FSCP or MFA designation offered through TTAIFA or courses offered by TTII.

They should have deep knowledge of the insurance solutions that they are selling, as well as, familiarity with the offerings of major competitors

They should be forthcoming with information and be willing to invest the time and effort to educate you so that you make an informed decision that you are comfortable with

Optionally, you might prefer a more seasoned professional who has a more established career in insurance sales. They are likely more knowledgeable, more familiar with the claims process and thus inspire more confidence. A rookie agent may be more flustered, pushy, desperate for a quick sale or just may not even stick around if they fail to achieve success in insurance sales. You'll want to build a lasting relationship as you review your coverage over time so you need someone who is dependable.

Even if you were only approached by an agent who represents one provider, be sure to reach out to others who represent their competitors so you can get comparable quotes for a similar policy. Be sure to ask each agent to highlight the key benefits of the policy that they are recommending that make it a better choice when compared to the other options available. A good agent will also point out features of the policy that may not be as favourable as competitors' offerings just so you are aware of its drawbacks. Naturally, they will frame the benefits as outweighing the limitations but only you can determine whether that works for you or not.

Choosing a Policy

It is often said that the best life insurance policy is one that is in-force when it is needed. Therefore, it's crucial to choose one that you're likely to stick with in the long-term i.e. the coverage continuously suits your future needs and the premiums are affordable and remain justifiable for your budget.

Sustainable Affordability

Remember, you'll be paying the premiums for years or even decades to come. It might be tempting to take out a million dollar policy just because you can afford it now, but if it becomes too expensive to maintain during periods of unemployment or financial strain, you might decide to cancel it or allow it to lapse and you will be left with no coverage. That's risky because it might be harder/more expensive to get coverage again as you get older.

Obviously, you should aim to get adequate coverage so you're not under-insured (i.e. the amount of money your beneficiary(ies) will be getting upon your death is far less than what they actually need to survive without you). However, you should be careful not to be enticed by the prospect of your heirs inheriting a fortune after your death or "leaving a legacy". If you aren't able to keep up with the higher premium payments for those million dollar policies and end up losing the coverage, then all the previous payments you had made would have been in vain...and your beneficiaries won't be getting a cent. Be realistic and reasonable with your future self and choose coverage you can afford.

Type of Life Insurance

Typically speaking, even though they may be marketed under a variety of names with all sorts of added benefits, there are 3 major types of life insurance available in T&T:

There is an ongoing debate about whether whole life is better than term life but you shouldn't automatically believe all of the arguments since they are based on generalisations. In reality, every insurance company structures their products differently so you should only compare actual life insurance proposals with one another when deciding which is best for you. Affordability and flexibility of benefits offered will be your guiding factors. Of the 3 options, term life will be the most cost-effective for the same amount of coverage but it does eventually expire. Some insurance companies, like TATIL Life, Sagicor Life and Pan American Life, give you the option to convert your term life policy into a whole life policy prior to its expiration but keep in mind that your premium will skyrocket!

Be Strategic about your Goals

In your effort to save money and maybe a bit of a headache, it may look like a good idea to get one life insurance policy with one provider that fills all of your needs. Local insurance companies have done an excellent job at designing complicated insurance bundles that are attractive on the surface but are a pain to decipher. However, it may be best for you to forego the allure of paying only premium and instead align your insurance policies with each of your goals separately. For example, if you want to leave an inheritance, consider taking out a life insurance policy without any riders. If you just want your family to be able to afford your funeral and clear off some debt, then get insurance specifically for final expenses. If you also want to save for retirement, open a separate deferred annuity plan. When you maintain a single policy that has competing benefits, you run the risk of losing one in favour of the other e.g. with Maritime, making a claim on a critical illness rider nullifies the death benefit and/or savings component on a life insurance policy if you had it all in one policy. Additionally, having separate policies gives you the flexibility to cancel those that no longer fit your needs/budget without jeopardising the ones that you'd still like to keep.

Prepare for the Process

Buying life insurance is a lot more like getting a loan than opening a bank account in that you have to apply, be assessed and ultimately be approved for coverage. Your agent will prepare a quote which gives an estimate of the premium you'll pay for the amount of coverage you want and you'll have to pay the 1st premium when you submit your application. During the underwriting process, the insurance may ask additional questions about your life and health or even require you to do medical tests. Sometimes they cover the cost of these tests (in which case the results go directly to them) but they may also ask you to pay for them yourself.

There are several likely outcomes:

Your application is approved and the quoted premium remains the same

Your application is approved with no exclusions but your premium is increased which you will have to agree to and pay

Your application is approved but with some exclusions i.e. your coverage does not apply if you die as a result of certain illnesses or conditions that you either have already or are predisposed to. An extra rating may also be applied causing your premium to increase. You will have to indicate whether you agree to these changes and pay the additional premium amount. If you don't, you can cancel and the premium payment will be returned to you

Your application is declined in which case your premium payment will be refunded

While the idea of paying a higher premium or being denied coverage altogether may tempt you to withhold details about your medical history in your application, it's not wise to do so. If you end up dying due to a pre-existing condition that you did not disclose, your family's claim for the death benefit that they are supposed to be entitled to could be denied if it is revealed during their investigation that you had lied on your application. In that case, you would have been diligently paying your premiums under the guise that you would have been covered for nothing. It's better to be honest upfront and hope that they still cover you even if it may mean that you have to pay a higher premium. Remember, having insurance is about having peace of mind so you shouldn't take the risk of not being covered.

Get the Specifics

Regardless of what the insurance agent says in their sales pitch, the only thing that truly matters is what's within the four corners of your insurance policy contract. This document spells out all of the terms and conditions of your life insurance policy. You are strongly encouraged to review it to ensure that you understand your coverage and that your agent had accurately represented the details to you. At the end of the day, your agent's word means nothing when it's time to make a claim, especially when decades have passed. If you are not happy with the terms or you feel as if you have been misled, don't be afraid to cancel the policy. The insurance company is bound only by the terms and conditions set out in the official policy contract so if it is important to you, make sure it is captured in the contract. Ensure to keep the physical document safe but also ask for a digital version for easy reference.

Don't be afraid to ask questions...lots of questions.

Premium Payments

Apart from the amount you'd have to pay, it's important to know how often you have to pay it. Find out what payment frequency options are available, whether your choice will affect the premium amount and how/when can you change it e.g, with Maritime, you will pay a higher premium if paying on a monthly basis than if you pay the annual premium all at once. You can only change your payment frequency when your anniversary date is approaching.

Also, confirm which payment methods are possible and opt for automatic payments like direct debits and standing orders. Make a note of alternative methods you can use in the event that there is an issue with your automatic payment. Maritime, Sagicor and Guardian Life all have online client portals that accept payments and you can easily do transfers via online banking for most insurance companies too.

You may also want to find out if it's possible to pay premiums in advance and what happens if you are late for or miss a payment. Is there a grace period before the policy lapses? Or is an Automatic Premium Loan set in motion once the policy has enough cash value as it is with Maritime Life policies? Would there be any fees or interest charges associated with that loan? Can anyone else make payments on your behalf once they have the policy number?

It might be a stretch but it's good to know whether and under what conditions your premium could be increased by the insurance company.

Cash Value

Term life policies have no cash value but whole life and universal life policies carry a savings or investment component that builds a cash value over time. Get an idea of how much of your premium payment goes towards building the cash value and at what interest rate you can expect it to grow. Ignore projections based on arbitrary or historical interest rates. Ask if there is a minimum guaranteed annual interest rate or a guaranteed cash value by a certain year or at a certain age. Do the math to determine if that future value would keep up with or beat inflation over the lengthy period of time. Hint: it usually doesn't.

Find out also if there is a maximum annual interest rate when the investments are performing well or whether your policy can lose any of its value when the investments are not doing well. Can withdrawals or loans be made against the cash value? Lastly, what happens to the cash value when you pass away? Is it paid out to your beneficiaries alongside the sum assured (e.g. Maritime Life and Pan American whole life insurance) or does it dissolve?

Withdrawals

If your life insurance policy has a cash value, then it may be possible to access some or all of it by requesting a withdrawal. Some insurance companies, like Sagicor, may charge a fee per withdrawal but no annual interest. Others, like Maritime, treat it as a secured personal loan and charge monthly interest that eats away at your cash value until the debt is fully paid off. There would also be limitations on how much and how often you can request a withdrawal. Clarify whether any withdrawals you make affect the amount your beneficiary ultimately receives when you die. Ideally, you don't want it to affect the actual coverage amount.

Changes and Updates

Will your life insurance be flexible enough to meet your changing needs over time? After all, it's life insurance and your life is bound to be full of changes. Find out whether, when/how often and under what conditions you'll be able to increase or decrease the sum assured, add or remove riders, add or remove beneficiaries, update the payment frequency etc. Depending on the type of policy you have you may also be able to change the allocation to your investment funds. It's worth noting that some term life policies will give you the option to convert it to a whole life policy before or at a certain time.

Cancellation

Buyer's remorse is a big part of the life insurance buying process, possibly because so many feel pressured by overzealous salespeople into committing to something that they don't understand the value of. It's almost inevitable that you may end up canceling a policy or you allow it to lapse. Whether it's intentional or not, it is still good to be aware of your options should you change your mind later on. Clarify whether your policy has a cash surrender value and whether there are any taxes or charges that will be levied against it if you cancel before a certain amount of time has passed.

Added Benefits

You will be given the option to include additional benefits such as a higher payout in the case of accidental death and dismemberment, waiver of premium due to disability or temporary loss of income, and more. Although these add-ons will increase the premium a bit, they are worth considering. Be sure to find out exactly how they change the policy if activated and what specific criteria have to be met in order for them to be applicable.

Payment of Benefits

The whole point of having life insurance coverage is to get the benefits due when they become due. Ensure that you know what your beneficiaries are entitled to receive when certain events occur. Upon your death, will they receive the sum assured alone or can they expect to receive the cash value too, if there is any? Would any withdrawals you make affect the amount to be paid? If you make a claim against a critical illness rider, will it nullify the death benefit? What happens if you pass away within 6 months of starting coverage? Which causes of death are covered or not covered?

Find out who can submit a claim and what they would need to present. Clarify if you can specify the % portion of the death benefit that each of your beneficiary gets and whether payments can be made to each separately or all beneficiaries at the same time.

Comments